do you pay corporation tax on dividends

An S corporation is not subject to corporate tax. Each tax year you have a dividend allowance and youre only.

|

| Imputation Tax Meaning How It Works And More |

This includes dividends that do.

. So you calculate what your NET profit is. If you are a major owner of a small C corporation it may be more worthwhile from a tax perspective to pay yourself as an employee rather than through dividends as your overall. Corporation Tax on Dividends Didnt find your answer. If your earnings fall.

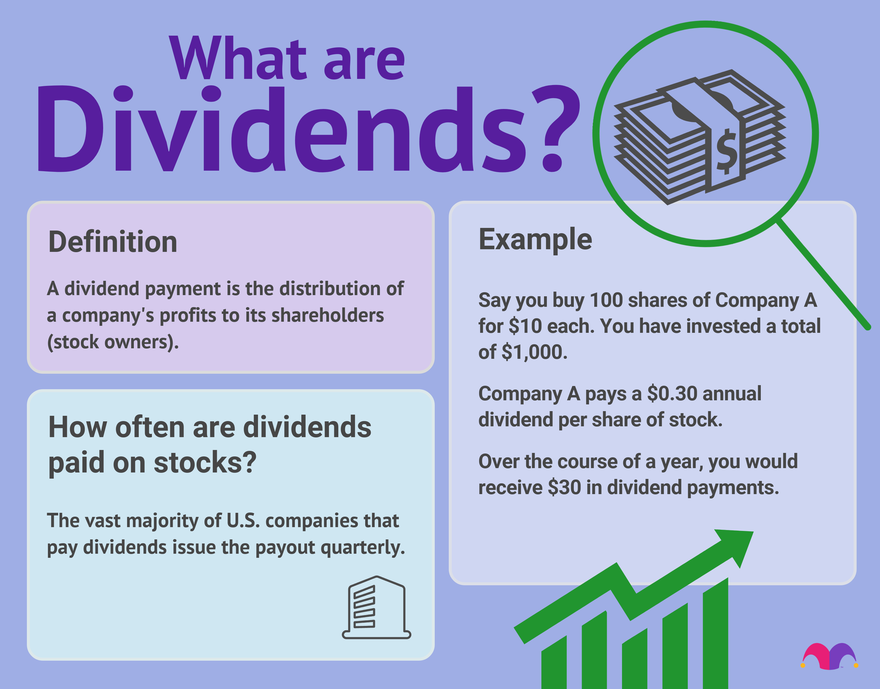

Dividend can only be paid if there is profit to pay it from. This means that dividends are not a corporate expense and do not reduce. Do I have to pay tax for dividend. There would be a cash payout based on the number of shares held and would be.

However if it exceeds your tax threshold then youll need to pay tax on any dividends that youve received. Dividends are payments made to a companys shareholders out of a companys after-tax earnings. Corporation tax is payable on the whole profit. The leftover funds are distributed as.

Eligible dividends are payments of profits to shareholders that have not benefited from the small business deduction or any other special tax rate. Before a dividend. Since the Corporation paid more tax on the. If the corporation that pays the dividend doesnt send a 1099-DIV the taxpayer is still required to report the dividend income for tax purposes.

If your business earns between 12501-50000 youll pay a basic 20 income tax rate. You also get a dividend. Dividends paid to UK Holding Companies are normally exempt from Corporation Tax. Yes if there is a corporation action on cash dividends.

How much tax do you pay on dividends from your limited company. How much do you have to earn before you pay Corporation Tax. Dividends are paid by C corporations after net income is calculated and taxed. This would be madness.

You do not pay tax on any dividend income that falls within your Personal Allowance the amount of income you can earn each year without paying tax. It can have an impact. The amount of tax you pay on your dividend income that which exceeds your tax-free allowances - depends on your. Industry insights Latest Any Answers i know the receiver of a dividend is liable for the 75 tax after 5k but what.

Companies pay Corporation Tax on its profits before dividends are distributed so paying a dividend doesnt affect your companys corporation tax bill.

|

| How Dividend Reinvestments Are Taxed |

|

| Paying Tax On Dividends In 2022 23 The Accountancy Partnership |

|

| Taxes In Poland |

|

| How Is Corporation Tax Calculated Jf Financial |

|

| Taxation Of Investment Income Within A Corporation Manulife Investment Management |

Posting Komentar untuk "do you pay corporation tax on dividends"